The IS Curve and Aggregate Demand

Week 04

ModernMacro team

Instituto Universitário de Lisboa (ISCTE-IUL)

March 2, 2026

1. The Components of Aggregate Expenditure

The Aggregate Demand for G&S

At the level of the entire economy, there are two sides in the market for Goods & Services (G&S):

- The Demand side: G&S are demanded, which is translated into a a set of “Planned Expenditures”

- The Supply side : G&S are produced/supplied at a certain market price.

The Aggregate Demand for G&S

. . .

The total amount of planned expenditures on G&S, which we will call by aggregate demand \((D)\) is given by: 1

\[D=C+I+G+NX \tag{1}\]

- \(C\): Personal consumption expenditures on G&S

- \(I\): Investment expenditures on G&S

- \(G\): Government purchases of G&S

- \(NX\): Net exports of G&S

Personal Consumption Expenditures

. . .

In a developed market economy, personal consumption expenditures \(C\) are explained by three fundamental variables:2

\[ C=\overline{C}+c \cdot \underbrace{(Y-T)}_{=Y_D}-b \cdot r \tag{2} \]

- \(\overline{C}\) : exogenous consumption expenditures

- \(Y\) : GDP, income, or “output”

- \(T\) : income taxes

- \(Y_D\) : disposable income

- \(r\) : real interest rate

- \(c>0\) : parameter (known as the “marginal propensity to consume”)

- \(b>0\) : parameter

Investment Expenditures

In a developed market economy, the level of investment depends upon:

- \(\overline{I}\) : exogenous investment (the textbook calls it “Autonomous” investment)

- \(r_i\) : real interest rate charged on investments

Banks charge \(r_i\) as the sum of the risk-free market real interest rate \((r)\) and the risk-premium or spread \((\overline{f})\):3 \[r_i=r+\overline{f} \tag{3}\]

Therefore, the demand expenditures on investment G&S will be given by: \[I=\overline{I}-d \cdot\underbrace{(r+\overline{f})}_{r_i} \tag{4}\]

- where \(d\) is a parameter: (\(d>0\))

Financial Frictions and Investment

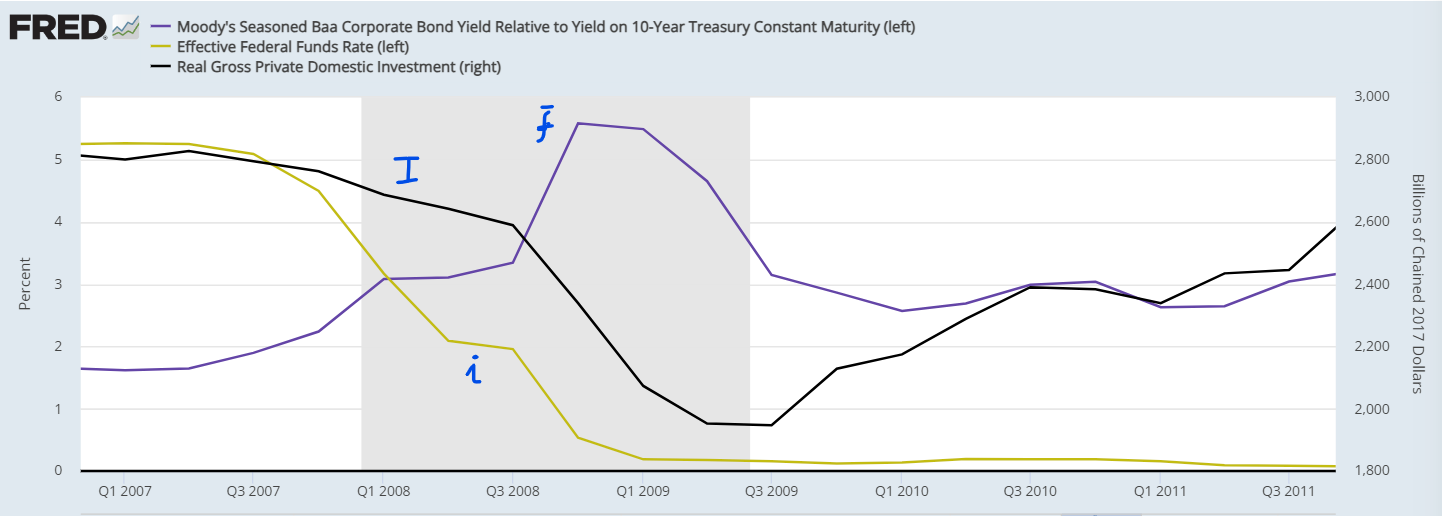

In the great financial crisis of 2007-2010, the inverse relationship between \((\overline{f})\) and \(I\) can be easily spotted in the figure below: \(\uparrow \overline{f}, \downarrow I\), despite \((i)\) going down. And \(\downarrow \overline{f}, \uparrow I\), despite \(i\) remaining at \(0 \%\).

Government Expenditures and Income Taxes

- The level of government expenditures on G&S is a result of a political decision in the Parliament

- So \((G)\) is exogenously determined: \[ G=\overline{G} \tag{5} \]

Government Expenditures and Income Taxes

The level of income taxes \((T)\) increases with income, so we could describe taxes with the following tax function: \[ T=\overline{T}+t \cdot Y \tag{6} \] where \(t\) is the marginal income tax rate.

However, for simplicity, we will assume that the level of income taxes is also exogenously determined: \[ T=\overline{T} \tag{7} \]

This simplification will not significantly change our results in this course.

Net-Exports Expenditures

Net-exports expenditures are made up of two components:

Autonomous net exports \((\overline{N X})\)

Net exports affected by changes in real interest rates \((r)\)

Putting together these two components, we get: \[ N X=\overline{N X}-x \cdot r \tag{8} \] where \(x>0\) is a parameter.

Why are net exports negatively dependent on the real interest rate?

See next slide.

Why \(r\) Affects Net-Exports?

An example. Suppose the ECB (European Central Bank) reduces interest rates in the EuroZone (EZ): \[ \downarrow r_{_{(EZ)}} \]

- This leads to financial investments denominated in € becoming less internationally attractive: they now have a lower return.

- Lower demand for € in the foreign exchange markets, leads to a depreciation of the € against other currencies.

- A depreciated € leads to G&S produced in the EuroZone becoming relatively less expensive than before, resulting in an increase in NX from Euro countries.

- So: \(\qquad \downarrow r \Rightarrow \text { national currency depreciates } \Rightarrow \uparrow N X\)

2. The IS Curve

The Relationship Betwwen GDP and Demand

. . .

From eq. (1), we saw that the level of aggregate demand is given by:

\[D=C+I+G+NX\]

. . .

And from week 2, we know that GDP \((Y)\) can be calculated by the sum of all expenditures on final G&S. So we must have:

\[Y=D \tag{9}\]

. . .

Therefore, we can relate GDP with the demand side by writing:

\[Y=C+I+G+NX \tag{10}\]

Eq. (10) allows us to obtain a very simple and useful curve: IS curve

Derivation of the IS Curve

To obtain an equation that reflects the impact of demand forces on the level of GDP \((Y)\), we have to do as follows:

. . .

\[Y=C+I+G+NX\]

. . .

\[ Y=\underbrace{\overline{C}+c \cdot(Y-\overline{T})-b \cdot r}_{=C}+\underbrace{\overline{I}-d \cdot(r+\overline{f})}_{=I}+\underbrace{\overline{G}}_{=G}+\underbrace{\overline{NX}-x \cdot r}_{=NX} \]

. . .

Rearranging better the previous equation, we get:

\[ Y=\overline{C}+\overline{I}-d \cdot \overline{f}+\overline{G}+\overline{N X}-c \cdot \overline{T}+c \cdot Y-(b+d+x) \cdot r \tag{11} \]

. . .

Smplify the exposition, by grouping together all the elements with an over bar, and call it the Exogenous/Autonomous Aggregate Demand:

\[ \overline{A}=\overline{C}+\overline{I}-d \cdot \overline{f}+\overline{G}+\overline{N X}-c \cdot \overline{T} \tag{12} \]

Derivation of the IS Curve (continuation)

Inserting eq. (12) into eq. (11), we get a very simple equation: \[ Y=\overline{A}+c \cdot Y-(b+d+x) \cdot r \]

. . .

which can be solved for \(Y\) as follows:

\[ Y=\frac{1}{1-c} \cdot \overline{A}-\frac{(b+d+x)}{1-c} \cdot r \tag{13} \]

. . .

But we can simplify it even further:

\[ Y=m \cdot \overline{A}-m \cdot \phi \cdot r \tag{14} \]

- \(\frac{1}{1-c}=m \quad \longrightarrow\) \(m\) is a parameter know as the demand multiplier

- \(b+d+x=\phi \quad \longrightarrow\) \(\phi\) is a parameter (or a sum of parameters)

The IS Curve: Summary

For the set of parameters \(\{m,\phi\}\), the level of Aggregate Demand and GDP \((D, Y)\) is positively affected by the level of the autonomous/exogenous aggregate demand \((\overline{A})\), and negatively by the level of the real interest rate \((r)\) : \[ Y=m \cdot \overline{A}-m \cdot \phi \cdot r \tag{14'} \]

. . .

- Notice that, to simplify things, we have defined:

- \(m=\frac{1}{1-c}>1\)

- \(\phi=b+d+x>0\)

- \(\overline{A}=\overline{C}+\overline{I}-d \cdot \overline{f}+\overline{G}+\overline{N X}-c \cdot \overline{T}\)

IS Curve: Graphical Representation

For a given level of \((\overline{A})\), an increase in \((r)\) will cause a reduction in aggregate demand \((D)\), which will lead to a decline in GDP \((Y)\), and vice-versa.

IS Curve: Graphical Representation

- \(\Delta r=+2pp\)

- \(\Delta \overline{A}=0\)

- \(\Delta Y=-2 trillion\)

- If \(\Delta \overline{A} \neq 0\), the IS would shift to the right/left

3. Forces that Shift the IS Curve

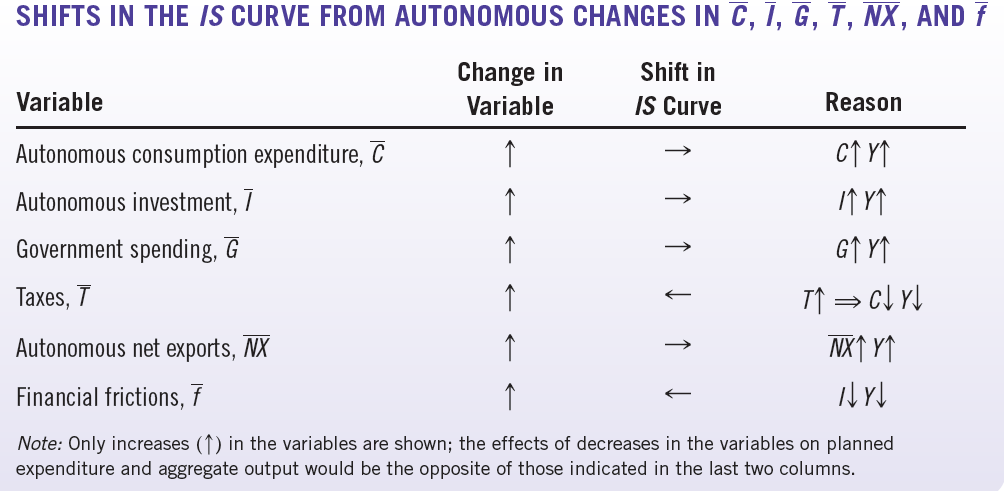

Exogenous Demand and Shifts in the IS Curve

Recall that the exogenous/autonomous aggregate demand is given by:4 \[ \overline{A}=\overline{C}+\overline{I}-d \cdot \overline{f}+\overline{G}+\overline{N X}-c \cdot \overline{T} \]

A change in any of these components of \(\overline{A}\) will force the IS curve to shift.

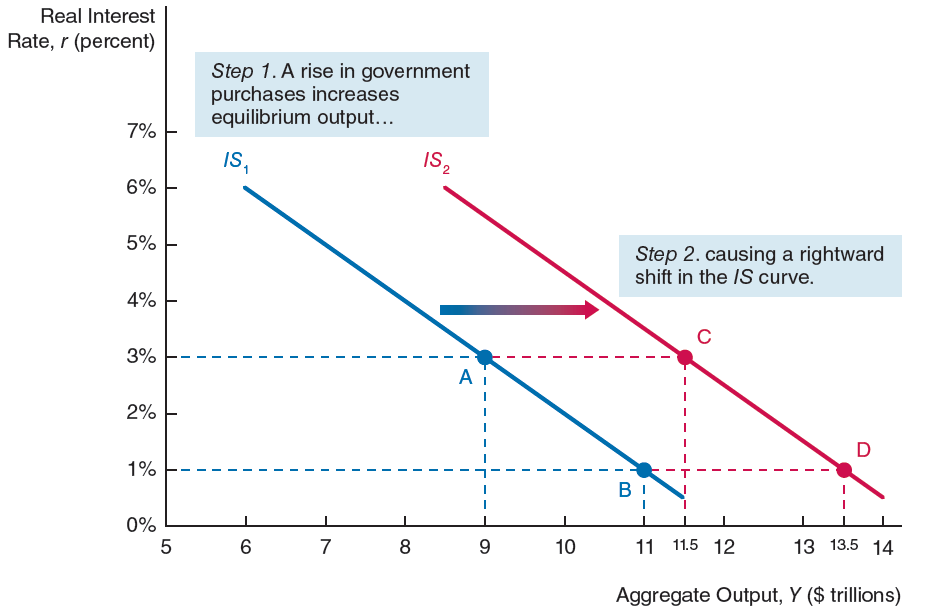

For example, consider an increase in public spending: \(\Delta \overline{G}>0\). From the expression above we get:

\[\Delta \overline{A}=\Delta \overline{G}>0\]However, from the IS curve we know that: \[ \Delta Y=m \cdot \Delta \overline{A} \quad \Longrightarrow \quad \Delta Y=m \cdot \Delta \overline{G} \]

Because \(m>1\), we have: \(\uparrow \overline{G} \Rightarrow \uparrow \overline{A} \Rightarrow \uparrow Y\) : the IS curve shifts to the right

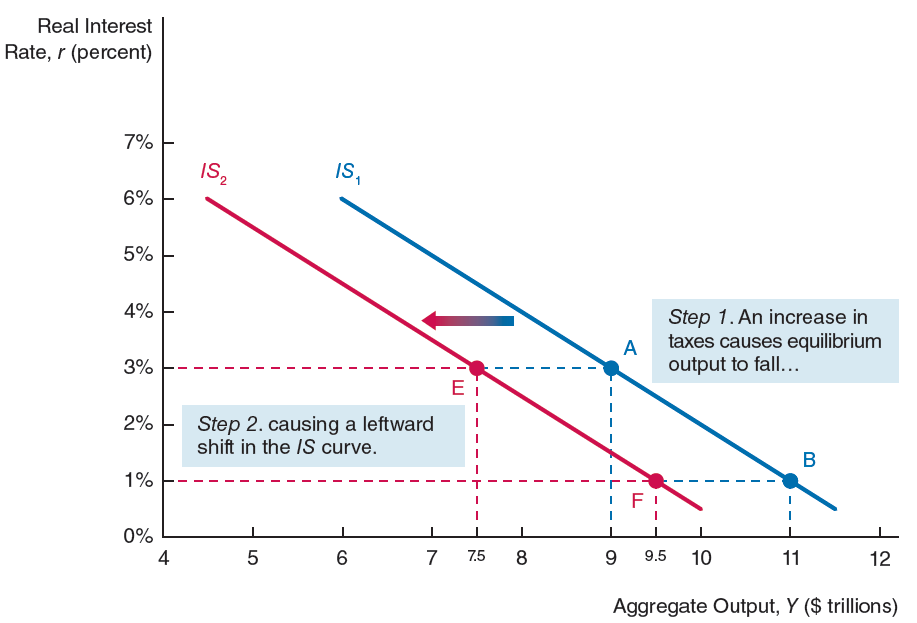

Another Example of a Shift in the IS Curve

The exogenous aggregate demand:\(\ \ \overline{A}=\overline{C}+\overline{I}-d \cdot \overline{f}+\overline{G}+\overline{N X}-c \cdot \overline{T}\)

A change in the spread (or as the textbook calls it: the “financial friction”) will also shift the IS curve. Suppose that the spread increases by \(4\) percentage points: \[\Delta \overline{f}=+4pp\]

From the exogenous aggregate demand expression above we get:

\[\Delta \overline{A}= - d \cdot \Delta \overline{f}= - d \times 4pp\]However, from the IS curve we know that: \[ \Delta Y=m \cdot \Delta \overline{A} \quad \Longrightarrow \ \Delta Y= m \cdot ( -d \times 4pp) \]

Because \(m>1, d>0\), we have: \(\uparrow \overline{f} \Rightarrow \downarrow \overline{A} \Rightarrow \downarrow Y\) : the IS curve shifts to the left

A Shift in the IS: a Graphical Example

If \(\uparrow \overline{G} \ \Rightarrow \ \uparrow \ \overline{A} \ \Rightarrow \ \uparrow Y\) , the IS shifts to the right:

. . .

- The IS shifts to the right for any \(r\) level

- The shift is the same for \(r=3\%\), \(r=1\%\), \(r=0\%\) , or …

A Shift in the IS: another Graphical Example

If \(\uparrow \overline{T} \ \Rightarrow \ \downarrow \ \overline{A} \ \Rightarrow \ \downarrow Y\), the IS shifts to the left:

. . .

- The IS shifts to the left for any \(r\) level

- The shift is the same for \(r=3\%\), \(r=1\%\), \(r=0\%\) , or …

The Multiplier of Aggregate Demand

An increase/decrease in \(\overline{A}\), will shift the IS curve leading to an increase/decline in aggregate demand and GDP. But by how much?

It will depend upon the value of the demand multiplier \(m\) and the value of the shock.

As \(0<c<1\), then \[ m=\frac{1}{1-c}>1 \quad \Rightarrow \quad \Delta Y= m \cdot \Delta \overline{A} \quad \Rightarrow \quad {\color{blue} {\Delta Y > \Delta \overline{A}}} \]

Where \(\overline{A}=\overline{C}+\overline{I}-d \cdot \overline{f}+\overline{G}+\overline{N X}-c \cdot \overline{T}\)

One shock upon \(\overline{A}\) is amplified/multiplied through the other components of expenditure: the higher \(c\) is, the higher will be \(m\).

A Textbook Useful Table

4. Readings

Readings

Read Chapter 9 of the adopted textbook:

Frederic S. Mishkin (2015). Macroeconomics: Policy & Practice, Second Edition, Pearson Editors

Footnotes

The textbook uses \(Y^{pe}\) instead of \(D\). For simplicity we choose \(D\) for “demand”. The notation is better and it is more intuitive.↩︎

In eq. (2), where we use \(c\), the textbook uses \(mpc\), and where we have \(b\) the textbook uses \(c\). Our notation is easier to manage.↩︎

The textbook calls \(\overline{f}\) a financial friction. The three terms represent the same thing: a measure of risk.↩︎

No need to memorize this expression. Try to understand which ones have a negative/positive impact upon \(\overline{A}\).↩︎